A financial plan can be defined as an exhaustive assessment of a person’s, business’s or other entity’s current and future financial situation. It is usually composed to evaluate the financial activities and position by following a certain template adapted to the user’s needs. There is no strict format of a financial plan that is obligatory to be followed.

Depending on one’s needs and goals, a financial plan can be composed and presented in different ways. A practical way of creating a financial plan is by using the mind mapping technique. In fact, mind maps are characterized by the ability to support organizing and outlining information, which makes them helpful for making a financial plan.

With a mind map, you could easily see the bigger picture of a specific situation. So if you make your financial plan with a mind map, you would be able to get a better perspective of your personal financial state and reflect on how certain aspects could and should be improved. A mind map is a perfect solution for representing a sound financial plan because it’s adaptable and flexible to change which is essential when it comes to personal finance.

Which financial elements you should include in your mind map?

One financial plan could consist of different components in accordance with the person’s objectives.

Depending on whether your primary goal is saving money for your children’s education, starting your own business, buying a home, or else, you can make an adjustable mind map that you would edit along the way.

In general, there are elements that are commonly used when creating a financial plan.

These are the primary things on which one concentrates when making a strategy for planning their finances for every stage of life.

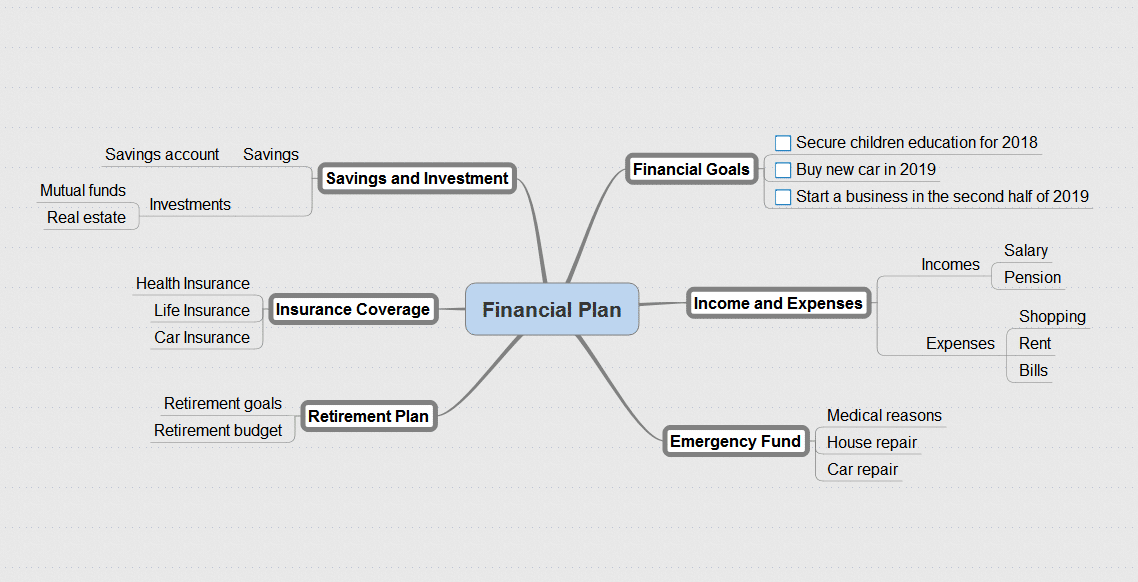

The Financial Planning mind map. Free download.

Financial Goals

Firstly and most importantly is to determine your financial goals. These should be specific, measurable, achievable, realistic, and time-bound. Under financial goals can be put various goals that a person could have such as buying a new house or car.

Once defined, you can organize your goals in one branch of the mind map, however, it is advisable to present them as projects so you could track your progress more easily. Once you create this branch you can always check how your goals are ‘performing’.

Income and Expenses

When you plan your finances, it is a must to plan your income and expenses. One branch of your map can serve for tracking your income and expenses on a monthly basis.

The income and expenses, i.e. the budget, can be calculated in many ways. One common way of budgeting you can use is the zero-based budget method which can help you to organize your money in advance. With zero base budget, you can map out your income and expenses while making sure you cover everything so that at the end your income minus your all your expenses equals zero.

You can choose a method for budgeting that meets your needs best. Usually, under income and expenses, you can put the following: salary, pension, benefits, shopping, groceries, rent, bills, etc.

Emergency Fund

The emergency fund is something you mustn’t forget when creating your financial plan. One branch of your financial mind map should definitely be reserved for outlining your emergency fund strategy.

So what should this branch consist of? In it, you can plan and follow the course of your reserves for so-called ‘dark days’.

Related reading: 7 Ways to Use Mind Maps in Your Business Reports.

Some experts advise that the fund should be large enough to cover three to six months of living expenses. So the amount of money you put in your emergency fund could be used for different reasons like medical reasons, house repair, car repair, or else.

Retirement Plan

A retirement plan is necessary when it comes to evaluating and securing your lifetime income and savings. In the branch dedicated to your retirement planning, you need to envision your retirement goals and calculate your retirement budget. The more reasonably you plan your retirement goals, savings, and expenses, the smaller the chance for unexpected hazards.

Insurance Coverage

Health insurance, life insurance, car insurance – these three kinds of insurance should represent the sub-branches of your insurance coverage branch. Although everyone’s financial plan and goals are diverse, you should have in mind that you will need some kind of insurance sometime in your life, so you should make it a part of your financial plan.

Savings and Investing

Saving money aside for future emergencies or purchases is usually done in financial institutions. One usually puts money in a savings account because of the need and desire to access it more easily and quickly and at the same time without a risk and with low taxes. Investing, on the other hand, means buying assets, like mutual funds or real estate, which would make money for you on the long-term.

In the mind map, you branch out your plans for saving and investing depending on your preferences.

About the author

Kristina Gjorgievska, a content writer and translator. Eternal inspiration: the magical Italy, Jim Morrison’s poetry, Bernardo Bertolucci’s timeless “Stealing Beauty”, and the dynamic and meditative Ashtanga Yoga. You can connect with Kristina on LinkedIn.